The Single Strategy To Use For Best Broker For Forex Trading

The Single Strategy To Use For Best Broker For Forex Trading

Blog Article

The Buzz on Best Broker For Forex Trading

Table of ContentsMore About Best Broker For Forex TradingThe Best Broker For Forex Trading Ideas7 Simple Techniques For Best Broker For Forex TradingOur Best Broker For Forex Trading IdeasHow Best Broker For Forex Trading can Save You Time, Stress, and Money.

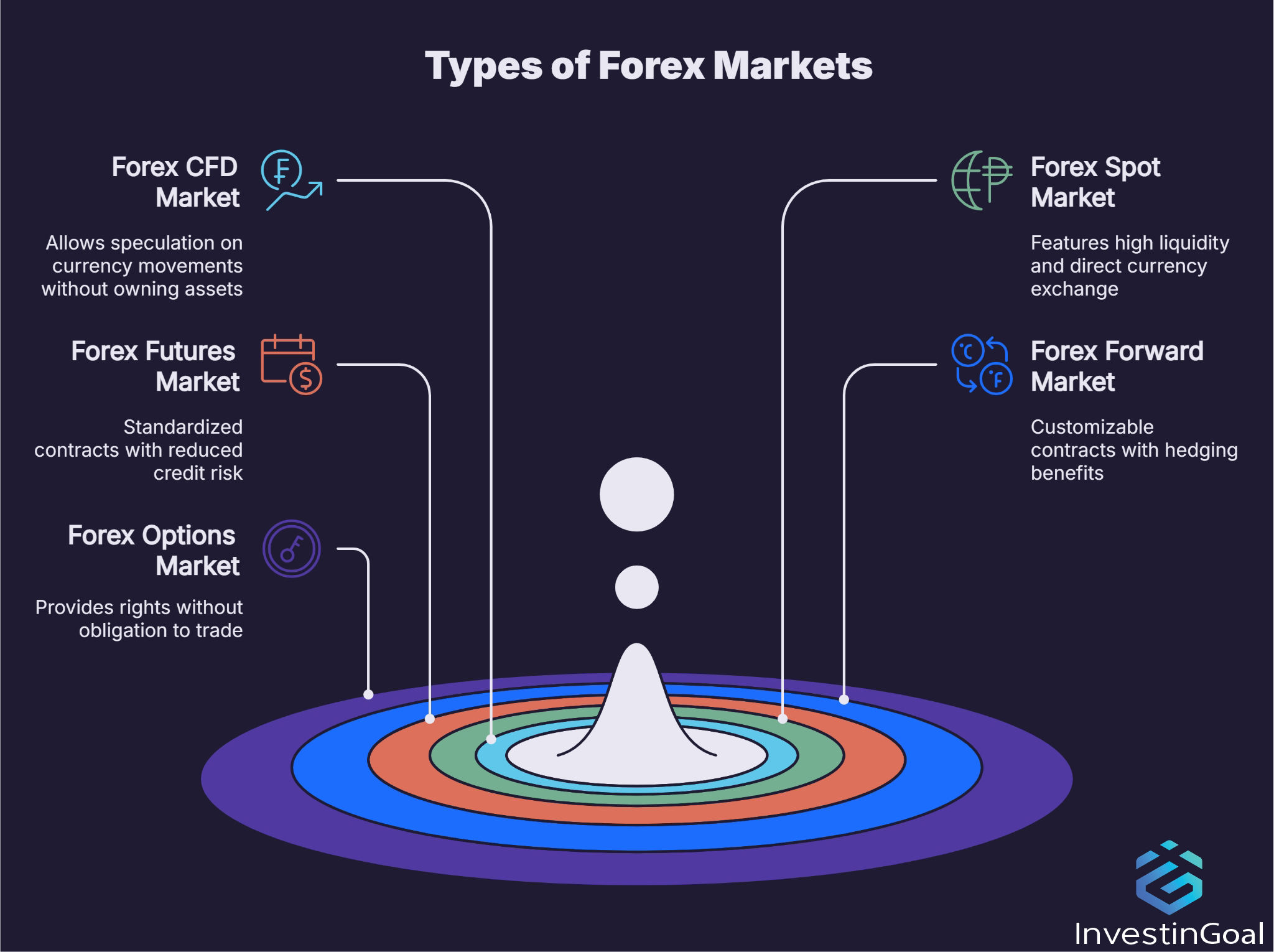

One money pair a person might desire to profession is the EUR/USD. If this certain set is trading for 1.15 pips, and they assume the exchange price will enhance in value, they could purchase 100,000 euros well worth of this money pair - Best Broker For Forex Trading.Generally, forex markets are shut on weekends, yet it's feasible some financiers still trade during off-hours. With the OTC market, purchases can take location whenever two events are ready to trade.

In discovering foreign exchange trading methods for novices, lots of retail investors obtain drawn in by the simple access to utilize without comprehending all the subtleties of the market, and leverage might amplify their losses. For those that choose to participate in forex trading, there are various approaches to select from.

Generally, forex trading strategies, like other kinds of investing, normally fall under a couple of camps: technological analysis or essential evaluation (Best Broker For Forex Trading). Along with basic analysis vs. technical evaluation, forex trading can additionally be based on time-related trades. These could still be based upon essential or technological analysis, or they may be extra speculative gambles in the hopes of making a quick earnings, without much analysis

Best Broker For Forex Trading Fundamentals Explained

Some time-based trading techniques consist of: Day trading entails acquiring and marketing the same placement within the very same day. For instance, if you day trade the EUR/USD pair, you may first purchase the position at a price of 1.10 and sell it later that day for 1.101 for a small gain.

A trader might discover that there's been recent momentum in the euro's strength vs. the United state dollar, so they could acquire the EU/USD set, in the hopes that in a week or so they can offer for a gain, before the momentum fizzles. Placement trading typically indicates long-lasting investing, as opposed to short-term supposition like with day trading, scalping, or swing trading.

The 5-Minute Rule for Best Broker For Forex Trading

bucks, triggering the rate of USD to get vs. JPY. Even if there's no evident hidden economic factor why the U.S. economic climate should be checked out extra favorably than the Japanese economic situation, a technical evaluation might recognize that when the USD gains, claim, 2% in one week, it has a tendency to increase one more 2% the following week based on momentum, with capitalists piling onto the profession for fear of losing out.

As opposed to technical evaluation that bases predictions on past cost movements, fundamental evaluation looks at the underlying economic/financial reasons why an asset's price may transform. If that occurs, then the USD could get toughness versus the euro, so a forex capitalist utilizing fundamental evaluation could attempt to get on the appropriate side of that trade. If U.S. passion prices are anticipated to fall faster than the EU's, that can trigger investors to prefer acquiring bonds in the EU, consequently driving up demand for the euro and damaging demand for the buck.

Again, these are just hypotheticals, yet the point is that essential evaluation bases trading on underlying factors that drive costs, besides trading task. Best Broker For Forex Trading. Along with identifying the right foreign exchange trading technique, it is very important to pick a strong forex broker. you could try these out That's since brokers can have various pricing, such as the spread they charge between deal orders, which can reduce into potential gains

While forex trading is normally much less purely regulated than stock trading, you still intend to select a broker that complies with pertinent regulations. As an example, in the U.S., you could try to find a broker that's regulated by the Commodity Futures Trading Compensation (CFTC) and the National Futures Association (NFA). You additionally intend to evaluate a broker's safety and security practices to make certain that your money is safe, such as inspecting whether the broker sets apart customer funds from their very own and holds them at managed financial institutions.

7 Easy Facts About Best Broker For Forex Trading Described

This can be subjective, so you might intend to try to find a broker why not try here that uses demonstration accounts where you can get a feeling of what trading on that particular platform looks like. Different brokers might have different account kinds, such as with some tailored much more toward newbie retail financiers, and others toward more expert traders.

Yes, forex trading can be risky, particularly for individual financiers. Banks and other institutional capitalists usually have an educational advantage over retail financiers, which can make it harder for people to profit from foreign exchange professions.

Report this page